From Legacy to Leading: Transforming Insurance with Cutting-Edge CCM Solutions

In the dynamic realm of insurance, the winds of change are reshaping the landscape, and at the forefront of this transformation is the journey from legacy systems to cutting-edge Customer Communication Management (CCM) solutions.

In the ever-evolving landscape of the insurance industry, staying ahead is not merely a choice; it's a necessity. The transformation from legacy systems to cutting-edge Customer Communication Management (CCM) solutions is proving to be the game-changer insurers’ need.

Looking at the rapidly changing dynamics of insurance sector especially, the rapid updates in compliance policies, it is imperative for the insurance companies to have seamless communication across all the channels ensuring the messaging is consistent and the customer is receiving personalised experience. As a result, insurance CCM solution market is expected to grow from $1.3 billion in 2021 to $2.2 billion by the end of 2026, says a report by Markets and Markets.

Understanding the Legacy Challenges in Insurance Sector

In the intricate web of the insurance sector, legacy challenges loom large, impeding progress and hindering the industry's ability to meet the demands of the modern era. Let's dissect some of the prominent legacy challenges that cast shadows on insurers, highlighting the pressing need for transformative solutions.

Outdated Technology Infrastructure

Legacy systems often resemble a labyrinth of outdated technology, making it cumbersome for insurers to adapt to the rapid pace of technological advancements. The integration of modern tools becomes a challenge, hampering efficiency and agility in day-to-day operations.

Siloed Data Management

Legacy systems are notorious for compartmentalizing data, creating silos that obstruct a holistic view of customer information. In an age where personalized and seamless customer experiences are paramount, these data silos become stumbling blocks to effective communication and relationship-building.

Compliance and Security Concerns

As regulatory landscapes evolve and cyber threats become increasingly sophisticated, legacy systems struggle to keep pace with the robust compliance and security measures required. Insurers find themselves grappling with the dual challenge of meeting regulatory standards while safeguarding sensitive customer data.

Unleashing Transformation with the Power of Modern CCM Solutions

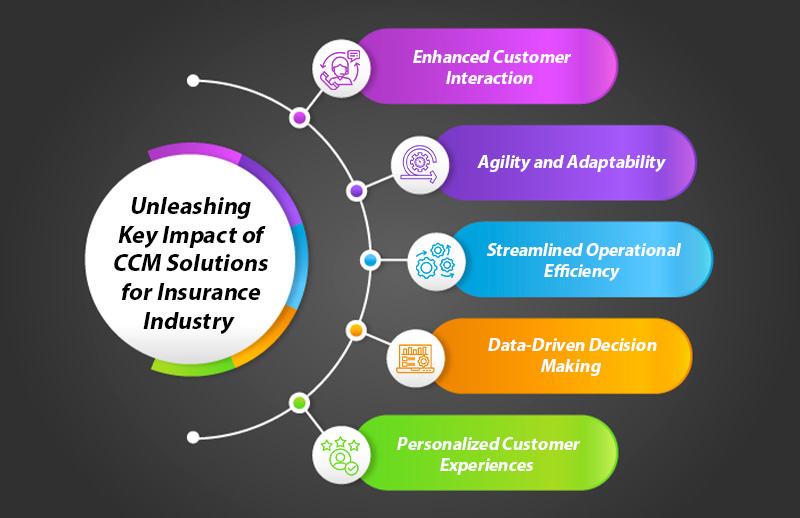

Here are five key points that illuminate the power of CCM in reshaping the dynamics of the insurance sector:

Enhanced Customer Interaction

CCM solutions redefine the way insurers communicate with their customers. Through personalized, real-time interactions, insurers can deliver information ranging from policy updates to claims processing seamlessly. This heightened level of engagement not only fosters customer satisfaction but also establishes a foundation for enduring customer loyalty.

Agility and Adaptability

In a dynamic industry where change is constant, agility is paramount. CCM solutions empower insurers with the flexibility to adapt swiftly to market changes, regulatory updates, and shifting customer expectations. This newfound agility positions insurers at the forefront of industry trends, giving them a competitive edge.

Streamlined Operational Efficiency

The integration of CCM solutions streamlines internal processes, revolutionizing operational efficiency. Automation of routine tasks reduces operational costs and liberates resources for more strategic initiatives. Insurers can redirect their human capital towards innovation, laying the groundwork for a more efficient and future-ready organization.

Data-Driven Decision Making

Data serves as the lifeblood of the insurance industry, and CCM solutions elevate data utilization to new heights. Through advanced analytics, insurers gain actionable insights into various facets of their operations, from risk assessment to customer behavior analysis. Informed decision-making becomes the norm, minimizing uncertainties and maximizing overall profitability.

Personalized Customer Experiences

CCM solutions empower insurers to tailor their communications to individual customer needs. This level of personalization goes beyond mere transactional interactions, creating a profound impact on customer satisfaction, retention, and, ultimately, revenue. Insurers leveraging CCM technology stand out in a crowded market by providing experiences that resonate with their diverse customer base.

Espire Paving the Road for Success for Insurance Players

Espire Infolabs is a leading Customer Communication Management (CCM) solution provider across the globe. The company houses two decades of experience in developing, delivering, and managing solutions catering to multiple industries around the world. Leveraging its experience, Espire’s solutions are designed specifically keeping the business requirements in mind. Let’s look at some of the use-cases where Espire helped insurance players with its meticulous CCM solutuions.

About Client

The client is amongst the largest British multinational general insurance company, with core markets in the UK & Ireland, Scandinavia and Canada. In partnership with different local players they are serving insurance services to nine million customers in over 100 countries.

Business Problem

In client’s existing system, carrying out any changes in multiple insurance related documents was not cost efficient and required TAT was too high. To mitigate challenges client needed a centralised portal, where a business user can leverage the self-serve feature for controlled IT involvement, change span/time to market and failure risk.

Major Challenges

Below are the major challenges that the client was facing:

Exhaustive Change Management Lifecycle

When developing new insurance related documents with the existing conventional approach, lot of time is consumed to edit simple changes. Hence, there was a need of a robust self-serviced CCM platform that could enable business users to make changes in the templates on their own, without spending too many hours of efforts.

Huge IT efforts spent on BAU Change Requests

To save multiplied efforts from IT teams, the client needed a visionary application to make changes on templates on their own, ensuring reduced IT operation cost on change requests.

Inability to make quick changes in Marketing Campaigns

For delivering effective personalised communications, client needed a self-serve platform, enabling quick changes in marketing campaigns at low cost, with ease and when needed.

Business Solution

Espire proposed a robust CCM solution to the client, where user can make most of the changes in insurance related document production with minimised IT efforts.

Some of the key aspects of Espire’s CCM solutions are:

- A single-sign on web-interface to access the range modular components provided through a product or client engagement, for all different business needs

- Business validations without IT involvement

- Control of change management through self-serve capabilities of the Portal

- Consistency of brand image application across the document template suite

- Ability to automate scheduling of print and digital channel campaigns, along with real time access to ongoing campaigns

To know more about the benefits and total approach on how Espire helped a leading insurance player in UK, read our case study, Delivering Consistent and Compelling Customer Communication with Self Serve Communication Portal

Let’s look at another use case where Espire helped a US-based insurance giant with its impeccable CCM solutions.

About Client

The client has been providing the critical infrastructure that powers corporate governance, capital markets and wealth and investment management for more than six decades. Their industry-specific technology, solutions, data, and intelligence power business transformation helps businesses get ahead of today's challenges while preparing for what's next.

Business Challenges

The client wanted to digitalise its key business processes, and sought to enhance its customer communication management (CCM) and customer experience (CX) for their staff legal division, NewCo Policy Administration division, and claims division. Below are the business goals that were set out to achieve :-

- Streamlining communication processes

- Reducing response turnaround time

- Enabling ad hoc communication creation

- Centralizing correspondence management

- Improving employee and business experiences

- Achieving exceptional CX for their end customers

Let’s understand the needs, challenges of all the 3 divisions:

Siloed Staff Legal Division

Client’s corporate legal division with 23 siloed law offices, responsible for legal matters and court filings with 100 different court venues, was seeking a better solution to manage its inventory of 10k templates and document and authoring processes by its lawyers and clerks. Due to court venues independently defining formatting requirements, document management and authoring significantly impacted case management processes.

Solution

Espire's solution involved rationalizing the vast template library of pleading, motions, correspondence, form, discovery, and miscellaneous documents to optimize content management. The implementation of OpenText Exstream Empower and Content Author facilitated centralized legal document generation and distribution. The integration with the core system, "Passport," enabled easy access to data and efficient legal responses across different offices. The system also ensured identity management and stored communication records for future references.

Policy Administration Division

The had launched new products to market covering 50 states of USA, hence creating modern customer centric communication correspondence and document at such scale was a key challenge along with generating numerous documents and capturing communication KPIs for successful product launches.

Moreover, generating large number of documents at different stages of customer journey and capturing communication KPI performance of established products within market was vital to launch the new product with due diligence and context driven customer communications.

Solution

Espire implemented OpenText Exstream Designer and Content Author, allowing business users to create, maintain, and update correspondence for different stages of the customer journey.

To know more, what approach Espire implemented to overcome the client’s challenges, and what benefits did the client received by joining hands with Espire, connect with us.

Conclusion

The journey from legacy systems to cutting-edge CCM solutions is pivotal for insurers aspiring to be at the forefront of the industry. The benefits are vast, from enhanced customer communication to operational efficiency and data-driven decision-making. Espire with its exceptional experience has become a key enabler of successful CCM solution implementations, proving that the organization is the leading CCM solution provider for Insurance sector globally.