Gartner's 5 Top Tech Trends Propelling Digital Transformation in the Insurance Industry by 2026

In an era of unprecedented change and digital acceleration, the insurance industry is at a crossroads, and this blog serves as your compass for the journey ahead.

Gartner's recent CIO Survey echoes the seismic shift, revealing that 58% of insurance respondents acknowledge the pandemic's role in amplifying funding for digital innovation until 2025.

The winds of change are ushering in a new era, one where insurers must not only adapt but lead in the adoption of transformative technologies to stay relevant and competitive.

This surge in digital innovation funding is not a mere anomaly but a herald of a transformative era where the role of CIOs within insurance enterprises transcends traditional boundaries. They are no longer confined to IT leadership; they are becoming primary advisors, charting the course for digital strategy and innovation to generate quantifiable value in an era of technological disruption.

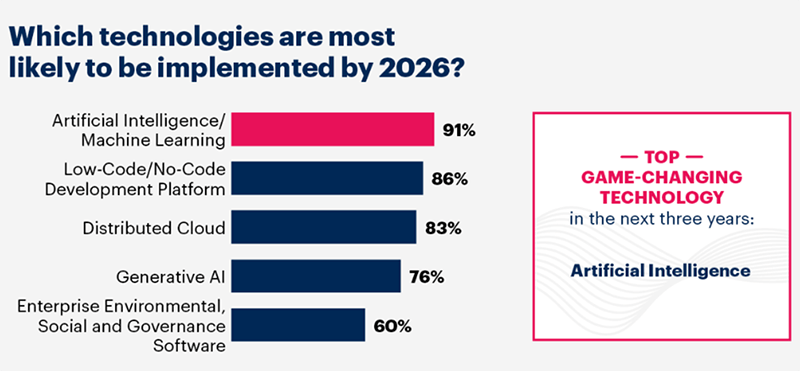

For insurance professionals seeking a strategic edge in the coming years, this blog offers a critical roadmap, unravelling Gartner's five key tech trends- AI/ML, Low-code/No-Code Platforms, Distributed Cloud, Generative AI, and ESG Software- are set to redefine the industry by 2026.

Top Five Tech Trends Transforming the Insurance Industry

1. Artificial Intelligence / Machine Learning

Integrating artificial intelligence (AI) and machine learning (ML) is bringing about significant advancements and potential effects on various aspects of insurance operations, causing a transformative shift in the insurance industry. The industry has embraced AI, ML and deep learning technologies, among others, because of their advantages for operations. Insurance-related AI/ML applications seek to improve operational efficiency, automate repetitive tasks, and analyze massive amounts of customer data to facilitate better decision-making and the provision of more profitable and customized insurance plans. Recent advancements highlight the industry's increasing reliance on cutting-edge technologies by showing a broad adoption of ML-driven predictive analytics for insurance underwriting.

The top five impacts of AI in insurance include automation, faster and more accurate risk assessment, improved prediction of Customer Lifetime Value (CLV), enhanced actuary modelling, and more effective fraud detection. These technologies have diverse applications in the industry, from streamlining customer service and claims processing to optimizing insurance pricing and underwriting.

Overall, the integration of AI and ML in insurance is poised to revolutionize traditional practices, leading to increased efficiency, better risk management, and improved customer experiences.

2. Low-code / No-code Development platform

According to Gartner’s report, more than 50% of insurance respondents have already deployed or plan to deploy low-code/no-code solutions within the next 12 months. This statistic underscores the growing significance of these platforms in the insurance sector.

A critical impact is seen in overcoming challenges associated with legacy environments. These platforms facilitate the creation of standard processes across diverse legacy systems, leading to improved operational efficiency. This is particularly crucial in an industry that often relies on complex and interconnected systems.

Furthermore, low-code/no-code solutions empower insurers to develop solutions for portals swiftly. This agility enhances customer interactions, improving experiences and faster response times. The ease of development also provides a more robust alternative not only to manual processes, reducing the likelihood of errors that may occur in less-sophisticated approaches, such as those relying on Microsoft Excel, but also reducing the dependency on IT teams for complexity involved in the platform development process.

So, the adoption of low-code/no-code platforms in the insurance industry is backed by compelling statistics, showcasing their pivotal role in modernizing operations, improving efficiency, and ultimately enhancing customer satisfaction.

3. Distributed Cloud

The rise of Distributed Cloud reflects a paradigm shift in how insurers manage and deploy their IT infrastructure. Unlike traditional cloud models, Distributed Cloud allows organizations to distribute cloud services across multiple locations. This enhances data privacy and security and offers greater flexibility and scalability.

Adopting Distributed Cloud means improved agility, reduced latency, and the ability to scale operations seamlessly for insurers. It enables a more responsive and resilient IT infrastructure, ensuring that insurers can adapt to changing market conditions while maintaining the highest security and compliance standards.

4. Generative AI

As per Gartner's survey, 49% of insurance CIOs have reported deploying AI and machine learning (AI/ML) initiatives, with basic chatbots, computer vision, and natural language processing (NLP) emerging as the closest-to-majority adopted AI techniques.

Generative AI plays a pivotal role in solving immediate challenges faced by insurers, particularly in automating manual tasks, supporting digital channel interactions, and expediting the identification of claims fraud.

By analyzing historical data and identifying patterns, generative AI aids in predicting and assessing risks. This capability allows insurers to make data-driven decisions, improve pricing models, and enhance overall risk management.

The technology's impact on fraud detection is significant, empowering insurers to fortify their systems, reduce financial losses, and uphold the integrity of their operations. Furthermore, Generative AI is instrumental in powering chatbots and virtual assistants, elevating customer interactions by providing instant support, addressing inquiries, and aiding in the claims process, thereby enhancing overall customer satisfaction.

Generative AI holds the promise of driving strategic transformation in the industry. It is envisioned to contribute to new product innovations, dynamic customer engagement, and comprehensive personalization. Furthermore, Generative AI's potential across the insurance value chain extends to internal processes and customer-facing interactions, impacting areas such as document processing, customer self-service, marketing, and data science, and core operations like claims, underwriting, and product filings. Ultimately, the adoption of Generative AI in the insurance sector signifies immediate improvements and positions insurers for long-term adaptability and innovation in a rapidly evolving landscape.

5. Enterprise Environmental, Social & Governance Software

As environmental, social, and governance considerations become integral to business strategies, Enterprise ESG Software emerges as a critical technology trend for insurers. This software enables companies to monitor and manage their environmental and social impact, ensuring compliance with ethical and sustainable business practices.

By implementing ESG Software, insurers can meet regulatory requirements and enhance their brand reputation and customer trust. This technology aligns insurers with global sustainability goals, driving positive business outcomes and contributing to a more responsible and resilient insurance industry.

Conclusion

Embracing technology trends for transforming the industry is not a choice but a necessity for insurers striving to remain relevant. These trends provide a holistic framework from operational efficiency to customer-centricity and sustainability. This blog is for the insurers who are enthusiastic to embark on a confident and visionary journey into the future defined by innovation and excellence.

Espire strategically aligns with the Gartner’s trends to empower the insurance industry. Leveraging AI/ML, we enhance customer acquisition and optimize business operations through advanced analytics. The Low-code/No-code Platforms enable personalized self-service portals, contributing to improved engagement. Espire's expertise in distributed cloud ensures seamless workflow management for reinsurance. In the realm of Generative AI, scalable claims solutions with fraud analytics mitigate financial challenges, and our managed services drive timely issue resolution, streamlining processes and enhancing operational efficiency. Espire propels the insurance sector as a comprehensive technology partner towards a digitally transformed and competitive landscape.

Learn how we can strengthen your business at www.espire.com/quick-contact or connect with us at marketing@espire.com.