6 reasons why Banks are adopting Big Aata Analytics

Data is the new asset. It is new because, without recent success in information technology, the use of data to drive growth was not possible earlier. The advent of new tools has enabled enterprises to capture huge of amounts of data for further storage and analysis with every aspect of commerce these days getting digitalized. Excel files have become the new destination for record-keeping as transactions are no more recorded in registers.

The new development in Big Data Analytics is hence redefining the banking and financial sectors as gathering, arranging and analyzing data is key determinants in this industry. We hereby note how data is used by banking sector to resolve their critical issues.

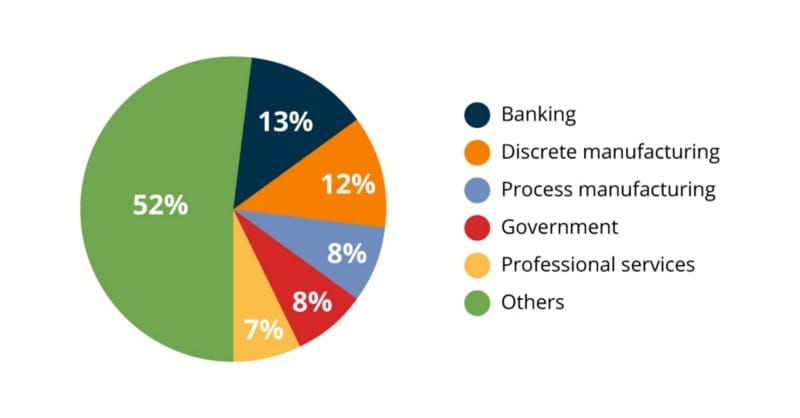

According to IDC Semiannual Big Data and Analytics Spending Guide in 2016 banking sector spent $20.8 billion in 2016 and has been the dominant consumer of Big Data services across industries.

Source: itsvit.com

Data Curbs Fraudulent Transactions

Hackers are the potential threat to customer accounts held in the banking systems. Banks today equipped with big data analytics record and study the data on consumer behavior to tackle the threat and thwart any fraudulent activity on the customer accounts. Analytics help in studying any unusual behavior on the account of customer that is not in consonance with the documented pattern and helps in raising alarm to concerned authorities.

Analytics Help Manage Risks Better

Banking sector constantly faces multifarious risks including specifically non-performing assets, breach of Basel norms and sluggish credit growth. Banks today with the help of data analytics can do a real-time analysis of the health of banking. Data analytics help in analyzing the reason why some borrowers are able to re-pay and others default on their payments. For instance, a bank operating with agro-based industry may witness downturn after a failed rainy season. With data on linkage between government policies, central bank and bank’s credit growth, it becomes easier for banks to foresee the impact of policy decisions on its profitability.

Customer Analytics- Provide relevant offerings

Big data analytics tools and techniques helps the banking sector with up-to-date statistics of their most profitable customers. Banks can thereby design effective business strategies to lure their customers by providing an excellent customer experience. Evidence-based data can be used by banks to maintain their first-class customers and thereby offer them relevant products.

Predictive Analytics - Future Planning

Banks can forecast and go for future planning strategies with the help of past transaction records monitored and analyzed through predictive analytics. It can help them keep a track of on-going market developments and plan future targets. Banks can use such analysis on a regular basis to highlight the risks associated with daily work of an organization.

Performance Analytics- Proper utilization of resources

Banks can monitor business and employee performance by customizing big data analytics and can then work on Employee KPI’s and budgets on the basis of previous accomplishments. Banks can monitor the performance of their employees and align their training and education in the direction of targets in real time. Hence, with maximum utilization of resources banks can make their products more trustworthy to their customers.

Analytics help in Cutting Costs

Data Analytics help banks today to monitor the number of staffs needed on a particular day of the week which helps in rationalization of workforce and goes a long way even in deciding whether to shut down an unproductive branch. The success of deployment of analytics is helping banks increase their online presence over sales executives as it helps them better monitor the number of policies bought online and the choices made for a particular plan. All this is helping banks drastically manage and reduce their cost of operation.

Big Data Analytics - Way Ahead for Banking Industry

Big Data Analytics is hence the key component for banking sector and its adoption into the existing workflow is one of the key elements for prevailing and surviving in the rapidly evolving business environment.

Espire Infolabs offers best in class data driven solutions leveraging our transformative Customer Engagement Hub framework in collaboration with our strategic partnerships to empower decision makers to effortlessly unlock enterprise data to study business patterns, predict risks and identify growth opportunities. We make it simple for business users to marry insights with credible business actions. Our approach involves setting up a sustainable, scalable and cost-effective analytics environment for business leaders, managers and executives to easily extract decision-ready tactical, operational and strategic level intelligence.