Boosting Customer Loyalty in Banking with Generative AI-Driven Customer Communication Management

In the increasingly competitive landscape of the banking industry, customer loyalty has become a critical differentiator. Financial institutions are vying for customer retention, seeking innovative ways to build trust and offer exceptional service. Generative AI (GenAI) has emerged as a transformative force, reshaping how banks communicate with their customers by offering personalized, timely, and intelligent interactions. With the global generative AI market projected to grow from $20.9 billion in 2024 to $136.7 billion by 2030, its application in banking is gaining momentum.

As banks shift towards customer-centric models, adopting AI-driven communication tools has proven to significantly enhance customer loyalty, engagement, and satisfaction. This blog explores the role of generative AI in boosting customer loyalty in banking, leveraging data to personalize communication, and providing a seamless, omnichannel experience.

A Brief History of Generative AI

Generative AI, a subset of artificial intelligence, involves algorithms that generate new content based on patterns and data inputs. Its foundation lies in neural networks, specifically Generative Adversarial Networks (GANs) and transformer models like GPT. Although AI has been around since the mid-20th century, the real breakthrough came with advanced machine learning models in the 2000s, leading to today's sophisticated AI tools. The rise of large language models in the 2020s significantly contributed to generative AI's prominence in industries like finance, healthcare, and entertainment.

With this technology, banks are now able to automate and personalize customer communication, streamline workflows, and offer services tailored to individual preferences.

How Generative AI Improves Customer Loyalty in Banking

Personalization at Scale

Generative AI enables banks to deliver highly personalized communication at scale. By analyzing customer data, such as transaction history and preferences, AI can tailor messages and recommendations, making the customer feel valued and understood. Personalized offers, reminders, and services enhance the customer's trust in the bank, leading to increased loyalty.

Real-Time Customer Support

With GenAI-powered chatbots and virtual assistants, banks can offer instant, 24/7 customer support. These AI systems not only answer common inquiries but can also resolve complex issues, improving the customer experience. Real-time responses create a sense of reliability and build customer loyalty.

Predictive Analytics for Customer Retention

Generative AI can predict customer behavior based on historical data, allowing banks to identify potential churn risks. By preemptively addressing customer concerns with personalized outreach, banks can reduce churn rates and enhance loyalty.

Omnichannel Engagement

GenAI enables banks to maintain consistent, personalized communication across various platforms- mobile apps, emails, social media, and in-branch. This omnichannel approach ensures a seamless customer experience, increasing engagement and loyalty.

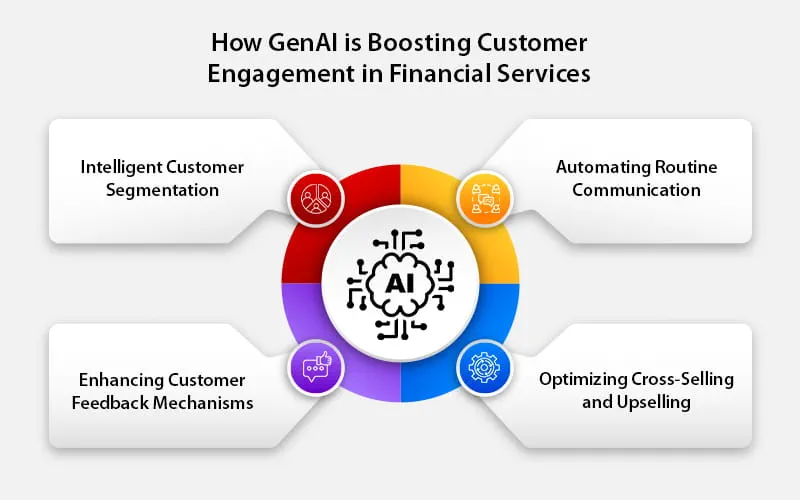

Using GenAI to Boost Customer Engagement in Financial Services

Intelligent Customer Segmentation

AI can segment customers based on behavioral patterns, allowing banks to target specific groups with tailored communication. By identifying distinct customer needs, banks can engage each segment more effectively, boosting overall customer satisfaction and engagement.

Automating Routine Communication

Generative AI excels at automating routine communications, such as transaction notifications, account balance updates, and loan reminders. Automating these tasks frees up bank employees for more complex inquiries while keeping customers informed, improving overall engagement.

Enhancing Customer Feedback Mechanisms

AI-powered tools can analyze customer feedback in real-time, identifying pain points and areas of improvement. This allows banks to address issues proactively, creating a more customer-focused approach that leads to higher engagement.

Optimizing Cross-Selling and Upselling

AI can analyze customer data to identify opportunities for cross-selling and upselling relevant financial products. By offering personalized suggestions for loans, credit cards, or investment options, banks can increase customer engagement and revenue streams.

Generative AI for Personalized Banking Communication

Creating Hyper-Personalized Marketing Campaigns

Generative AI can create personalized marketing content tailored to individual customers. From personalized email campaigns to targeted social media ads, banks can reach their audience more effectively, improving conversion rates and customer satisfaction.

Dynamic Content Generation

AI tools can dynamically generate content based on customer interactions, such as FAQ responses or service recommendations. This ensures that each customer receives relevant information in real-time, improving the personalization of communication.

Automating Document Creation

From generating personalized statements to automating loan agreements, GenAI can streamline document creation. This not only saves time but also ensures that customers receive documents tailored to their needs and preferences, enhancing satisfaction.

Multilingual Support

Generative AI can automatically translate and adapt communication into multiple languages, ensuring that customers from diverse linguistic backgrounds receive personalized communication in their native language, fostering inclusivity and loyalty.

Best Practices for AI-Driven Customer Communication in Banking

Data Privacy and Security

When using AI to enhance customer communication, ensuring data privacy and security is paramount. Banks must comply with regulations such as GDPR and prioritize customer consent for data use to build trust.

Maintaining Human Oversight

While AI can handle a large volume of customer communication, human oversight is necessary for sensitive issues or complex inquiries. Maintaining a balance between automation and human intervention ensures a smooth customer experience.

Continuous Learning and Optimization

AI-driven systems must be regularly updated to reflect customer preferences and behavior. Banks should continuously monitor and optimize AI algorithms to ensure communication remains relevant and effective.

Feedback Loops

Incorporating customer feedback into AI models helps to refine and improve communication strategies. Using feedback to train AI systems enables better personalization and enhances customer satisfaction over time.

Role of AI in Improving Customer Retention in Banks

Identifying At-Risk Customers

AI algorithms can analyze customer data to identify patterns that indicate dissatisfaction or risk of churn. By addressing these issues proactively, banks can improve customer retention rates.

Personalized Loyalty Programs

Generative AI can help banks design personalized loyalty programs based on customer preferences and behavior. Offering tailored rewards and incentives keeps customers engaged and increases their likelihood of staying with the bank.

Reducing Wait Times with AI-Powered Services

AI-driven communication tools, such as virtual assistants, reduce wait times for customers seeking support, which leads to higher satisfaction and retention.

Offering Proactive Financial Advice

Generative AI can provide personalized financial advice based on a customer’s spending habits and financial goals. Offering proactive advice strengthens the customer’s relationship with the bank and enhances loyalty.

Conclusion: Generative AI- A Game-Changer for Customer Loyalty in Banking

Generative AI is revolutionizing customer communication in the banking sector, enabling financial institutions to offer highly personalized, timely, and efficient services. From enhancing customer engagement to improving retention rates, AI-driven communication strategies are integral to fostering long-term customer loyalty. Banks that invest in generative AI will not only strengthen their customer relationships but also remain competitive in an increasingly digital landscape. To transform your banking customer communication management and enhance customer retention with GenAI, connect with us today.