How Data Analytics is Transforming the Future of Banking and Financial Services

In today's rapidly evolving financial landscape, data analytics has emerged as a key driver in transforming the future of banking and financial services. With vast amounts of data generated daily, the ability to harness and interpret this data is revolutionizing how banks and financial institutions operate. From enhancing customer experience to improving risk management and fraud detection, data analytics is reshaping the sector at every level.

The Power of Data Analytics in Banking

Data analytics in banking is not just a trend; it is a necessity for modern financial institutions. With the ability to analyze customer data, transactional data, and market trends, banks can make informed decisions that optimize operations and enhance profitability. Big data in finance allows institutions to predict future trends, mitigate risks, and tailor services to meet customer needs.

Enhancing Customer Experience Through Data Analytics

One of the most significant impacts of data analytics in banking is its ability to improve the customer experience. By leveraging customer data, banks can create more personalized experiences, offering tailored financial products and services that meet individual needs. How data analytics improves customer experience is evident in personalized product recommendations, targeted marketing campaigns, and better customer support.

For example, by analyzing transaction history, banks can suggest relevant products such as loans, credit cards, or investment opportunities. This not only increases customer satisfaction but also drives customer loyalty and retention.

Predictive Analytics for Financial Risk Management

Predictive analytics is a game-changer for financial services analytics, particularly in risk management. Financial institutions face various risks, from credit risks to market risks. Predictive analytics helps banks identify potential risks before they materialize, allowing them to take preemptive actions to mitigate losses.

Using historical data and advanced algorithms, banks can forecast credit defaults, market fluctuations, and even macroeconomic changes. This helps them adjust their strategies accordingly, ensuring better preparedness for potential challenges.

The Role of AI and Data Analytics in Modern Banking

Artificial intelligence (AI) and data analytics are a powerful combination in the banking sector. AI-powered data analytics enables banks to automate decision-making processes, analyze vast amounts of data in real-time, and provide insights that drive efficiency.

Automation of Routine Processes

AI, combined with data analytics, is automating many routine tasks in banking such as processing loan applications, verifying customer information, and handling transactions. By using AI algorithms to sift through large volumes of data, banks can reduce manual work, minimize errors, and process transactions more quickly. This improves efficiency and allows staff to focus on more complex, value-adding tasks.

Real-Time Fraud Detection and Prevention

One of the most crucial roles of AI and data analytics in banking is in enhancing fraud detection systems. AI algorithms analyze massive amounts of transaction data in real-time to identify unusual patterns that might indicate fraud. For example, if a customer’s account is accessed from an unexpected location or experiences abnormal spending behavior, AI-driven systems can flag these activities immediately, helping prevent fraud before it occurs.

Improved Customer Support Through AI-Powered Chatbots

Banks are increasingly using AI-powered chatbots to improve customer support. These chatbots, driven by data analytics, can interact with customers, answer queries, and even guide users through complex banking processes. With access to detailed customer data, these chatbots can provide personalized assistance, enhancing the overall customer experience and reducing the need for human intervention.

Personalized Financial Services and Products

AI and data analytics allow banks to offer personalized financial products and services based on individual customer data. By analyzing spending habits, transaction history, and financial goals, banks can tailor offerings like loans, credit cards, and investment products to meet the specific needs of each customer. This level of personalization not only boosts customer satisfaction but also helps banks build deeper, long-term relationships with their clients.

Enhanced Decision-Making with Predictive Analytics

AI-driven predictive analytics is revolutionizing decision-making in banking. By analyzing historical data and current market trends, AI systems can predict future customer behaviors, market shifts, or potential financial risks. This allows banks to make more informed decisions in areas such as risk management, investment strategies, and loan approvals. Predictive analytics also helps banks anticipate customer needs, ensuring they remain competitive in an ever-evolving market.

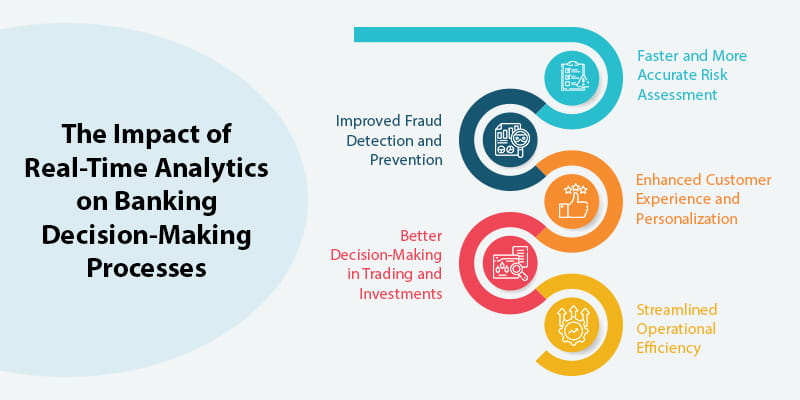

The Impact of Real-Time Analytics on Banking Decision-Making Processes

Real-time analytics has transformed how banks make decisions, allowing them to operate with unprecedented speed and precision. Here are several key ways that real-time analytics impacts decision-making processes in the banking sector:

Faster and More Accurate Risk Assessment

Real-time analytics enables banks to assess risks quickly and accurately. For instance, in credit and loan approvals, banks can instantly analyze a customer’s financial history, current transactions, and external market factors to determine the risk of default. This swift analysis reduces the time it takes to make lending decisions while ensuring that risks are evaluated comprehensively and with current data. In the past, risk assessments were based on historical data that could be outdated by the time decisions were made, but real-time analytics ensures decisions are based on the most up-to-date information available.

Improved Fraud Detection and Prevention

Real-time data allows banks to detect and respond to fraudulent activities immediately. Banks analyze transaction data as it happens, flagging any unusual behavior that could indicate fraud, such as abnormal spending patterns or unexpected access to accounts. Traditional fraud detection systems often lag behind real-time transactions, allowing fraudulent activities to go undetected for longer periods. By using real-time analytics, banks can prevent fraud before significant damage occurs, safeguarding both their customers and their assets.

Enhanced Customer Experience and Personalization

Real-time analytics helps banks offer a more personalized experience to customers. By analyzing transactions, account activity, and preferences in real-time, banks can recommend relevant financial products or services that suit an individual's needs. For example, if a customer frequently makes international purchases, real-time analytics can suggest services such as currency exchange or travel-related financial products. This immediate understanding of customer behavior allows banks to tailor their offerings dynamically, improving customer satisfaction and engagement.

Better Decision-Making in Trading and Investments

For banks involved in trading and investment activities, real-time analytics is crucial for making swift, informed decisions. In markets where conditions can change in seconds, the ability to process data instantly allows traders to react to shifts in market prices, interest rates, or economic indicators. Real-time analytics provides actionable insights, helping banks make decisions that capitalize on market opportunities or mitigate losses. This agility in decision-making can significantly affect profitability, especially in high-stakes financial environments like stock exchanges or commodity markets.

Streamlined Operational Efficiency

Real-time analytics also plays a vital role in optimizing internal banking operations. By continuously monitoring workflows, staffing levels, and customer demand, banks can make immediate adjustments to enhance efficiency. For example, if a particular branch is experiencing a high volume of customers, real-time analytics can prompt the bank to allocate more resources to that location. Similarly, banks can optimize digital services based on real-time usage patterns, ensuring that their platforms remain robust during peak transaction periods. This data-driven approach ensures that banking operations are efficient and responsive to real-time needs.

Big Data and Its Role in Transforming Traditional BFSI (Banking, Financial Services, and Insurance)

The emergence of big data has revolutionized the traditional BFSI sector, offering new opportunities for innovation, efficiency, and customer-centric services. With the increasing volume, variety, and velocity of data, financial institutions are leveraging big data to transform their operations, drive decision-making, and remain competitive in an evolving digital landscape. Here are several ways big data is reshaping the BFSI sector:

Enhanced Customer Insights and Personalization

One of the most significant impacts of big data on BFSI is the ability to gain deeper insights into customer behavior. By analyzing vast amounts of data generated from customer interactions, transactions, and social media, financial institutions can understand their customers more comprehensively. This data helps banks and insurers segment their customers more accurately, tailor financial products and services, and personalize customer interactions.

Improved Risk Management and Compliance

Risk management is at the heart of banking and financial services, and big data is transforming how institutions assess and mitigate risks. By analyzing historical data, market trends, and real-time data, financial institutions can make more informed decisions about credit risk, market risk, and operational risk.

In addition, big data plays a crucial role in helping financial institutions meet regulatory requirements. With regulatory bodies demanding more transparency and accountability, financial institutions must ensure compliance with various laws, such as anti-money laundering (AML) and Know Your Customer (KYC) regulations. Big data allows institutions to monitor transactions in real-time, detect suspicious activity, and generate compliance reports automatically, reducing the risk of penalties and legal repercussions.

Optimizing Operations and Reducing Costs

Big data analytics helps financial institutions streamline their operations and reduce costs by identifying inefficiencies and areas for improvement. Banks, for instance, can analyze data from branch transactions, ATM usage, and digital banking platforms to optimize branch operations and staffing levels. This data-driven approach helps banks allocate resources more effectively, minimize overhead costs, and improve overall operational efficiency.

In the insurance sector, big data can streamline the underwriting process by automating the analysis of claims data and customer profiles. This leads to faster claims processing, better risk assessment, and more accurate pricing of insurance policies. By using big data to automate and optimize internal processes, financial institutions can achieve significant cost savings.

Advanced Fraud Detection and Prevention

Fraud is a major concern for the BFSI sector, and big data is proving to be a powerful tool in combating it. By analyzing patterns in transaction data, payment behavior, and customer interactions, financial institutions can identify suspicious activity and flag potential fraud in real-time.

Moreover, in the insurance industry, big data helps insurers detect fraudulent claims by analyzing behavioral patterns and cross-referencing data from different sources. This proactive approach reduces fraudulent activities, saving companies millions in payouts.

Driving Innovation in Financial Products and Services

Big data is also driving innovation by enabling financial institutions to develop new products and services that cater to the evolving needs of customers. Through the analysis of customer data and market trends, banks and insurers can identify gaps in the market and develop innovative solutions.

For instance, big data allows banks to introduce new digital services like robo-advisors, mobile banking apps, and peer-to-peer payment platforms, all of which are tailored to the digital-first preferences of today’s customers. In the insurance industry, big data is driving the development of usage-based insurance (UBI), where premiums are calculated based on real-time data, such as driving behavior for auto insurance.

By harnessing the power of big data, financial institutions can stay ahead of the competition by continuously innovating and adapting to changing market dynamics.

Predictive Analytics for Investment and Market Forecasting

Big data is also transforming how financial institutions approach investment strategies and market forecasting. By leveraging predictive analytics, financial institutions can analyze historical data and market trends to forecast future financial scenarios, such as stock price movements, interest rate changes, and economic shifts.

This ability to predict market changes allows banks and investment firms to make more informed decisions, minimize risks, and seize profitable opportunities. In addition, big data enables portfolio managers to assess market sentiment, track real-time trading patterns, and make data-driven investment decisions that align with market conditions.

Transforming Customer Service through Data-Driven Insights

Big data plays a key role in enhancing customer service within the BFSI sector. With access to customer data, financial institutions can predict potential issues, such as loan defaults or payment delays, and provide proactive support. This helps institutions address customer concerns before they escalate, leading to improved satisfaction and long-term loyalty.

Conclusion

Data analytics is fundamentally transforming the future of banking and financial services. From enhancing customer experiences and optimizing operations to improving fraud detection and risk management, data analytics is reshaping the sector in ways that were once unimaginable. As financial institutions continue to harness the power of data, the future of banking will become more efficient, secure, and customer-focused. To know how you can leverage Data and analytics for your BFSI business, connect with our experts today.