Generative AI in insurance transforming the industry with smarter automation | Part2

As we explored in the first part of this blog series, Generative AI (GenAI) is revolutionizing the insurance industry by automating processes, enhancing customer experiences, and improving risk assessment. With AI-powered underwriting, fraud detection, and personalized policy offerings, insurers have already seen significant operational improvements.

However, as we step into 2025, GenAI’s role in the insurance sector is evolving even further. With advancements in large language models (LLMs), multimodal AI, AI-driven hyper-personalization, and real-time predictive analytics, insurers are unlocking new opportunities for efficiency, security, and customer engagement.

In this section, we will explore the key GenAI trends shaping the insurance sector in 2025, providing insights into how insurers can leverage these innovations for long-term success.

Key GenAI Trends in the Insurance Sector in 2025

Generative AI is advancing rapidly, and insurance businesses must stay ahead of emerging trends to maintain their competitive edge. Here are the top GenAI trends transforming the insurance industry in 2025:

AI-Driven Hyper-Personalization for Policyholders

Customers now expect highly personalized insurance experiences tailored to their unique lifestyles, risk profiles, and preferences. In 2025, AI-driven hyper-personalization will take center stage, allowing insurers to offer customized policies, dynamic pricing, and tailored risk coverage in real time.

How It Works

- AI continuously analyzes customer behavior, financial data, IoT data (wearables, smart devices), and claim history to craft hyper-personalized policies.

- Dynamic policy adjustments ensure that coverage and premiums evolve based on changes in a customer’s risk profile.

- AI-driven virtual agents provide personalized recommendations and proactive renewal reminders, improving customer engagement.

AI-Powered Real-Time Risk Assessment & Predictive Analytics

Traditional risk assessment models rely on historical data, which can be inaccurate or outdated. In 2025, insurers will adopt real-time AI-powered risk assessment models that leverage predictive analytics to anticipate potential claims before they happen.

How It Works

- AI integrates real-time data streams from IoT sensors, geolocation data, climate monitoring, and social media activity to assess risks dynamically.

- Predictive AI models analyze data from previous claims, medical reports, and financial behavior to forecast claim likelihood and fraud risks.

- Proactive risk mitigation allows insurers to offer preventive guidance to policyholders, reducing overall claims frequency.

Multimodal AI for Advanced Decision-Making

2025 will see a rise in multimodal AI, where GenAI models can process and analyze multiple data types simultaneously - including text, images, videos, and structured data. This evolution will significantly enhance claims processing, underwriting, and fraud detection.

How It Works

- AI will analyze handwritten claim documents, accident photos, medical reports, and sensor data together to make more accurate and faster claim decisions.

- Voice and video AI analysis will help in processing customer interactions, ensuring transparency and compliance.

- AI will cross-reference multiple sources to detect fraud, ensuring higher accuracy in assessments.

AI-Powered Autonomous Insurance Assistants

In 2025, autonomous AI-driven insurance assistants will replace traditional chatbots by providing real-time, intelligent, and context-aware customer support. These AI assistants will handle policy recommendations, claims queries, and fraud assessments with near-human accuracy.

How It Works

- AI assistants will learn and adapt based on historical interactions, providing more personalized customer interactions.

- Customers will be able to file claims, modify policies, and receive instant updates through AI-driven voice assistants and chatbots.

- AI will proactively guide policyholders through the claims process, reducing the burden on human agents.

AI-Driven Autonomous Claims Processing

With advancements in computer vision and deep learning, 2025 will see a shift towards autonomous claims processing, where AI handles claims from submission to final settlement with minimal human intervention.

How It Works

- AI will process photos and videos from policyholders to assess damages instantly.

- AI-powered predictive analytics models will determine claim authenticity, fraud probability, and required payouts.

- Automated settlement recommendations will speed up compensation approvals, reducing wait times for customers.

Ethical AI and Explainable AI (XAI) for Regulatory Compliance

As AI adoption grows, so do concerns about AI bias, transparency, and ethical decision-making. In 2025, insurers will prioritize Explainable AI (XAI) to ensure regulatory compliance and build customer trust.

How It Works

- AI systems will provide transparent reasoning behind underwriting, claims approvals, and pricing decisions.

- Insurers will implement bias-detection algorithms to ensure fair risk assessments.

- AI models will comply with evolving data privacy laws and ethical guidelines, ensuring responsible AI usage.

GenAI Implementation Best Practices for Insurance Businesses

As Generative AI (GenAI) continues to redefine the insurance sector, businesses must ensure strategic implementation to maximize its potential. A well-planned GenAI adoption strategy enhances efficiency, compliance, and customer satisfaction while minimizing risks. Below are some best practices for seamless GenAI implementation in the insurance industry:

Define Clear Business Objectives and AI Use Cases

Before implementing GenAI, insurers must align AI adoption with their business goals. Whether the focus is on automating claims processing, improving risk assessment, or enhancing customer engagement, clarity in objectives ensures a targeted and measurable AI deployment.

- Identify high-impact use cases such as fraud detection, underwriting automation, and hyper-personalization.

- Align GenAI applications with regulatory compliance and industry standards.

- Establish KPIs (Key Performance Indicators) to measure AI success.

Invest in High-Quality, Compliant Data

GenAI models rely on massive volumes of data for training and decision-making. However, poor-quality or biased data can lead to inaccurate predictions and unfair policy decisions.

- Ensure data accuracy, completeness, and diversity to minimize AI biases.

- Implement strong data governance frameworks for regulatory compliance (GDPR, HIPAA, etc.).

- Utilize data anonymization and encryption techniques to protect customer privacy.

Foster AI Transparency with Explainable AI (XAI)

AI-driven decisions must be explainable and transparent to gain customer trust and regulatory approval. Black-box AI models can create uncertainty and ethical concerns in insurance policies.

- Use Explainable AI (XAI) frameworks to provide clear reasoning behind GenAI-driven underwriting and claims decisions.

- Regularly audit AI models for biases, ensuring fair and non-discriminatory AI practices.

- Offer human oversight mechanisms, allowing manual review of AI-generated outputs.

Prioritize Seamless AI Integration with Existing Systems

Most insurance companies operate on legacy IT infrastructures, making AI adoption challenging. A seamless GenAI integration ensures smooth collaboration between AI-driven insights and human expertise.

- Use API-driven AI solutions that easily integrate with core insurance systems (CRM, policy management, claims processing).

- Adopt a modular AI approach, allowing gradual AI adoption without disrupting existing workflows.

- Train insurance teams on AI-augmented decision-making, balancing automation with human judgment.

Implement AI Security and Fraud Prevention Measures

With AI-driven automation, cybersecurity threats and AI-generated fraud have become significant concerns. Insurers must build robust AI security protocols to safeguard customer data and prevent fraudulent claims.

- Deploy AI-driven cybersecurity solutions to monitor fraudulent activities.

- Use multi-layer authentication to prevent AI-driven identity fraud.

- Conduct regular AI audits to identify vulnerabilities and ensure compliance with evolving regulations.

Enable Continuous AI Learning and Optimization

GenAI models must evolve to adapt to changing customer behaviors, market trends, and risk factors. A continuous learning approach ensures that AI remains accurate, relevant, and effective.

- Use reinforcement learning and real-time data training to enhance AI decision-making.

- Implement human-in-the-loop (HITL) AI models where experts refine AI-generated insights.

- Continuously update AI algorithms to comply with new regulations and market shifts.

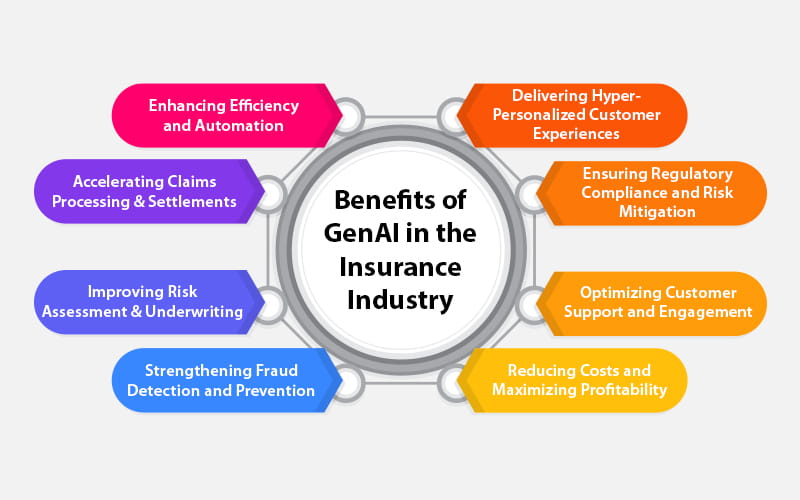

Benefits of GenAI in the Insurance Industry

The insurance industry is undergoing a rapid transformation, with Generative AI (GenAI) emerging as a powerful enabler of efficiency, automation, and personalized customer experiences. By leveraging advanced AI models, insurers can streamline operations, reduce fraud, enhance underwriting accuracy, and improve customer engagement. GenAI not only optimizes existing processes but also creates new opportunities for growth and innovation.

Enhancing Efficiency and Automation

GenAI automates repetitive tasks such as claims processing, policy issuance, and customer inquiries, drastically reducing processing times and minimizing errors. AI-driven document processing and workflow automation free up human agents to focus on more strategic tasks, improving overall efficiency.

Accelerating Claims Processing and Settlements

Traditional claims processing is slow and prone to errors. GenAI streamlines claim verification, fraud detection, and approvals by analyzing documents and policy terms in real time. Faster settlements lead to improved customer trust and reduced operational costs for insurers.

Improving Risk Assessment and Underwriting

AI-powered underwriting leverages predictive analytics to assess risks more accurately. By analyzing vast datasets, including historical claims and market trends, insurers can make more informed decisions, set competitive premiums, and minimize underwriting losses.

Strengthening Fraud Detection and Prevention

Insurance fraud costs billions annually, but GenAI significantly improves fraud detection. AI models analyze transaction patterns, detect anomalies, and flag suspicious claims in real time. By preventing fraudulent activities, insurers save costs and ensure fair payouts.

Delivering Hyper-Personalized Customer Experiences

AI-driven recommendation engines analyze customer preferences and behaviors to offer tailored policy options. Chatbots and virtual assistants provide real-time support, improving engagement and retention. Personalization enhances customer loyalty and drives long-term business growth.

Ensuring Regulatory Compliance and Risk Mitigation

AI helps insurers stay compliant with regulations by automating checks and ensuring transparency in decision-making. Explainable AI (XAI) enhances accountability, while AI-driven monitoring tools keep insurers updated with evolving regulatory frameworks.

Optimizing Customer Support and Engagement

GenAI-powered chatbots and voice assistants handle customer queries instantly, assisting with claims, policy selections, and renewals. 24/7 AI support enhances service efficiency, reduces agent workload, and ensures a seamless customer experience.

Reducing Costs and Maximizing Profitability

By automating workflows, improving risk predictions, and detecting fraud, GenAI helps insurers cut operational costs. AI-driven efficiencies lead to reduced claims leakage, lower administrative expenses, and increased profitability, allowing for reinvestment in innovation.

How Espire Helps Insurance Businesses in Seamless GenAI Implementation

As the insurance industry embraces Generative AI (GenAI), businesses must navigate complex challenges, including regulatory compliance, data security, and operational efficiency. Espire, a global leader in AI-driven digital transformation, enables insurers to integrate GenAI seamlessly, ensuring efficiency, accuracy, and enhanced customer experiences. Through a strategic and customized approach, Espire helps insurers leverage GenAI’s potential while addressing key implementation challenges.

Developing a Strategic AI Roadmap for Insurance

One of the first steps in Espire’s approach is developing a well-defined AI strategy and roadmap. Many insurance businesses struggle with identifying the most effective use cases for GenAI. Espire conducts comprehensive AI readiness assessments, evaluates existing infrastructure, and formulates an adoption strategy tailored to the insurer’s specific needs. By defining clear AI applications across underwriting, claims processing, and fraud detection, Espire ensures a structured and goal-oriented AI transformation.

Enhancing Policy and Claims Automation with AI

AI-powered automation is at the core of Espire’s solutions, significantly enhancing policy management and claims processing. Traditional methods often lead to inefficiencies, delays, and increased operational costs. Espire integrates AI-driven document recognition for instant claims validation and predictive analytics to automate underwriting decisions. Additionally, chatbots and virtual assistants streamline customer interactions, reducing the time required for policy inquiries and claims settlement. These AI-driven enhancements improve overall efficiency while elevating customer satisfaction.

Strengthening Fraud Detection and Risk Mitigation

Fraud detection remains a critical challenge in the insurance sector, costing billions annually. Espire employs advanced AI-powered anomaly detection systems that identify fraudulent claims patterns in real time. The integration of biometric authentication and deep learning models strengthens fraud prevention strategies, while real-time fraud monitoring minimizes financial losses. By leveraging AI’s predictive capabilities, Espire ensures that insurers can proactively detect and mitigate risks.

Delivering Hyper-Personalized Customer Experiences

Personalization is a key driver of customer retention in today’s insurance landscape. Espire helps insurers deliver hyper-personalized experiences through AI-driven recommendation engines and sentiment analysis. Chatbots and voice assistants enhance customer engagement by providing tailored policy recommendations and real-time support. These AI-powered personalization strategies enable insurers to build stronger customer relationships, resulting in higher retention and increased customer lifetime value.

Ensuring AI Compliance, Security, and Ethical Practices

GenAI adoption comes with significant regulatory and security concerns. Espire ensures that all AI implementations comply with industry regulations such as GDPR and HIPAA, maintaining transparency and ethical AI practices. The incorporation of Explainable AI (XAI) provides clear insights into AI-driven decisions, allowing insurers to maintain accountability and regulatory compliance. AI-powered encryption and access control mechanisms further enhance data security, ensuring that customer information remains protected.

Seamless Integration with Legacy Insurance Systems

Seamless integration of AI solutions with existing insurance systems is crucial for successful adoption. Many insurers operate on legacy IT infrastructure, which may not be AI-ready. Espire addresses this challenge by implementing API-driven AI models that integrate smoothly with core insurance platforms, including policy management, claims processing, and CRM systems. The modular AI approach allows for gradual implementation, minimizing disruptions while ensuring real-time data synchronization.

Continuous AI Optimization and Support

AI models require continuous learning and optimization to remain effective. Espire provides ongoing AI training, incorporating real-time data to enhance accuracy and performance. The use of human-in-the-loop AI models allows for continuous refinement, ensuring that AI-driven decisions align with business goals and evolving market trends. Espire’s 24/7 AI support and performance monitoring further guarantee seamless operations and long-term AI success.

Conclusion

By partnering with Espire, insurance businesses can unlock the full potential of GenAI while overcoming implementation challenges. From policy automation and fraud detection to hyper-personalization and regulatory compliance, Espire’s AI-driven solutions empower insurers to stay ahead in a competitive landscape. With a future-ready AI transformation strategy, insurers can achieve greater efficiency, enhanced security, and superior customer experiences.

To revolutionize your insurance business with GenAI, connect with Espire today and accelerate your AI-powered transformation.