The Digital Transformation of Insurance Industry through Data and Analytics

The insurance industry is undergoing a profound transformation, driven by the relentless advancements in data analytics. As insurers strive to meet the ever-evolving demands of the digital age, the ability to harness and interpret vast amounts of data has become a game-changer. The integration of sophisticated data analytics tools is not just a trend but a necessity for survival and growth in today's competitive landscape.

Owing to rapid adoption of data and analytics solution in insurance industry, reports indicates that the global insurance analytics market is projected to grow from $8.8 billion in 2020 to $20.6 billion by 2026, at a CAGR of 15.1% during the forecast period of 2020-2026. This digital transformation is redefining the way insurers operate, paving the way for more informed decision-making and innovative solutions.

Harnessing Data for Competitive Edge in the Insurance Industry

Data and analytics has emerged as a pivotal tool that can transform how insurers operate, allowing them to stay ahead of competitors by making informed decisions and improving various aspects of their business. Here’s an in-depth look at how data analytics can be harnessed for a competitive advantage in the insurance sector:

Enhanced Risk Assessment and Underwriting

One of the most significant applications of data analytics in insurance is in risk assessment and underwriting. Traditional underwriting processes rely heavily on historical data and manual assessments, which can be time-consuming and prone to human error. Advanced data analytics enables insurers to:

- Analyze a broader range of data sources: Incorporate data from social media, IoT devices, and other non-traditional sources to gain a more comprehensive understanding of risks.

- Predict future risks: Use predictive models to forecast potential risks and adjust underwriting criteria accordingly, leading to more accurate and fair pricing.

- Tailor insurance products: Develop customized insurance products that cater to specific customer segments, thereby attracting a wider customer base.

Deep Customer Insights

Understanding customer behavior and preferences is crucial for delivering personalized services and products. Data analytics allows insurers to:

- Segment customers effectively: Group customers based on various attributes such as demographics, behavior, and purchasing patterns to target them with relevant offers.

- Identify emerging trends: Recognize shifts in customer needs and preferences, enabling insurers to adapt their strategies and offerings promptly.

- Enhance customer engagement: Use insights to engage with customers proactively, addressing their needs and concerns, which leads to higher satisfaction and loyalty.

Robust Fraud Detection

Fraud is a significant concern in the insurance industry, leading to substantial financial losses. Data analytics enhances fraud detection capabilities by:

- Identifying patterns and anomalies: Detect unusual patterns and behaviors that indicate potential fraud, such as excessive claims or inconsistencies in reported information.

- Automating fraud detection: Implement machine learning algorithms that continuously learn from new data, improving their ability to detect fraud over time.

- Reducing false positives: Minimize the number of legitimate claims flagged as fraudulent, thereby improving the efficiency of the claims process and customer satisfaction.

Streamlined Claims Management

Efficient claims management is vital for maintaining customer trust and operational efficiency. Data analytics improves claims management by:

- Automating claims processing: Use AI and data analytics to automate routine tasks, such as claim validation and payout calculations, reducing processing time and costs.

- Predicting claim outcomes: Analyze historical data to predict the likely outcome and cost of claims, allowing insurers to set aside appropriate reserves and manage financial risk effectively.

- Enhancing customer experience: Provide faster and more accurate claim settlements, leading to higher customer satisfaction and retention.

Effective Competitive Benchmarking

Understanding how a company performs relative to its competitors is crucial for strategic planning. Data analytics supports competitive benchmarking by:

- Comparing performance metrics: Analyze key performance indicators (KPIs) such as customer acquisition costs, claim processing times, and profitability against industry benchmarks.

- Identifying areas for improvement: Highlight areas where the company lags behind competitors, allowing management to implement targeted improvements.

- Tracking competitor strategies: Monitor competitors’ product launches, marketing campaigns, and other strategic moves to stay ahead in the market.

Data-Driven Strategies for Maximizing Insurance Efficiency and Profitability

In the insurance industry, efficiency and profitability are critical for sustaining competitive advantage and ensuring long-term success. Data-driven strategies have become indispensable tools for insurers aiming to optimize their operations and maximize financial performance. Here are detailed insights into how data analytics can be leveraged to enhance efficiency and profitability in the insurance sector:

Operational Efficiency

Operational efficiency is crucial for reducing costs and improving service delivery. Data analytics can streamline operations in several ways:

- Process Automation: Automate routine tasks such as data entry, policy administration, and claims processing using AI and machine learning, reducing human errors and operational costs.

- Resource Optimization: Analyze workforce performance data to allocate resources more effectively, ensuring that high-priority tasks are adequately staffed.

- Supply Chain Management: Optimize the supply chain by predicting demand and managing inventory, reducing waste and improving service levels.

Customer Segmentation

Customer segmentation involves dividing customers into distinct groups based on specific criteria. This strategy allows insurers to tailor their marketing and service efforts more effectively:

- Behavioral Segmentation: Group customers based on their behavior, such as purchasing patterns and claim history, to develop targeted marketing campaigns.

- Demographic Segmentation: Use demographic data to create personalized insurance products that cater to different age groups, income levels, and geographic locations.

- Needs-Based Segmentation: Identify and segment customers based on their specific needs and preferences, enhancing customer satisfaction and loyalty.

Pricing Optimization

Accurate pricing is essential for maintaining competitiveness and profitability. Data analytics enables insurers to develop dynamic pricing models:

- Risk-Based Pricing: Use data to assess the risk profiles of individual customers and set premiums accordingly, ensuring fair and competitive pricing.

- Real-Time Pricing Adjustments: Implement dynamic pricing models that adjust premiums in real-time based on market conditions and customer behavior.

- Competitive Analysis: Monitor competitors’ pricing strategies and adjust your own to remain competitive while ensuring profitability.

Resource Allocation

Efficient resource allocation is crucial for maximizing productivity and minimizing costs. Data analytics provides insights into optimal resource management:

- Workforce Analytics: Analyze employee performance data to identify productivity trends and optimize workforce allocation, ensuring that high-priority tasks receive adequate attention.

- Budget Allocation: Use data to allocate budgets more effectively across different departments and projects, ensuring optimal use of financial resources.

- Project Management: Leverage data to prioritize projects based on their potential impact on efficiency and profitability, ensuring that resources are focused on high-value initiatives.

The Impact of Machine Learning and Data Analytics on Insurance

The integration of machine learning (ML) and data analytics is transforming the insurance industry, driving innovation, improving efficiency, and enhancing customer experiences. These advanced technologies enable insurers to process vast amounts of data, uncover insights, and automate complex processes. Here’s an in-depth look at the profound impact of ML and data analytics on the insurance sector:

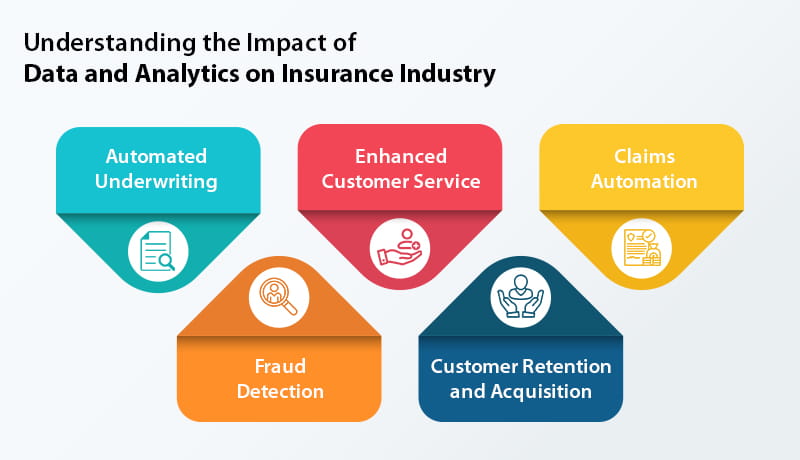

Automated Underwriting

Traditional underwriting processes can be time-consuming and prone to inconsistencies. Machine learning models streamline and enhance these processes by:

- Risk Evaluation: ML algorithms analyze large datasets to assess risk factors more accurately, leading to more precise underwriting decisions.

- Speed and Efficiency: Automated underwriting significantly reduces the time needed to process applications, improving customer satisfaction and operational efficiency.

- Consistency and Accuracy: ML ensures consistent underwriting standards and minimizes human error, resulting in fairer and more reliable assessments.

Enhanced Customer Service

Machine learning and data analytics play a crucial role in elevating customer service standards within the insurance industry:

- Chatbots and Virtual Assistants: AI-powered chatbots provide instant responses to customer inquiries, improving service speed and accessibility.

- Personalized Interactions: ML analyzes customer data to offer personalized recommendations and solutions, enhancing the overall customer experience.

- Proactive Support: Predictive analytics allows insurers to anticipate customer needs and address potential issues before they arise, fostering stronger customer relationships.

Claims Automation

Efficient claims management is essential for customer satisfaction and cost control. Machine learning enhances claims processing by:

- Automated Claims Processing: ML algorithms can automate the initial review and validation of claims, reducing processing time and administrative costs.

- Fraud Detection: Advanced ML models identify patterns and anomalies that indicate fraudulent claims, improving detection rates and reducing losses.

- Predictive Claims Analysis: ML predicts claim amounts and outcomes, enabling insurers to allocate resources and reserves more effectively.

Fraud Detection

Insurance fraud is a significant challenge that results in substantial financial losses. Machine learning enhances fraud detection capabilities by:

- Pattern Recognition: ML algorithms identify complex patterns and correlations in data that may indicate fraudulent activity, improving detection accuracy.

- Behavioral Analysis: ML models analyze customer behavior and flag deviations that suggest potential fraud, enabling timely intervention.

- Automated Monitoring: Continuous monitoring of transactions and claims using ML ensures that suspicious activities are detected and addressed promptly.

Customer Retention and Acquisition

Machine learning and data analytics contribute to customer retention and acquisition by providing deeper insights into customer behavior and preferences:

- Churn Prediction: Predictive analytics identifies customers at risk of leaving, allowing insurers to implement targeted retention strategies.

- Personalized Marketing: ML analyzes customer data to create personalized marketing campaigns that resonate with specific segments, improving acquisition rates.

- Enhanced Customer Insights: Comprehensive data analysis provides a 360-degree view of customers, enabling insurers to tailor their products and services to meet individual needs.

How Espire Helps the Insurance Industry with Its Data and Analytics Solutions

By leveraging advanced technologies and a deep understanding of the sector, Espire empowers insurers to enhance their operations, improve customer experiences, and achieve strategic objectives. Here’s how Espire’s data and analytics solutions make a significant impact on the insurance industry:

Optimized Data Management

Effective data management is the cornerstone of successful analytics. Espire helps insurers manage their data more efficiently through:

- Data Integration: Seamlessly integrating data from various sources such as policy management systems, customer databases, and third-party providers, ensuring a unified and consistent data repository.

- Data Storage Solutions: Offering scalable and secure data storage solutions that facilitate easy access and retrieval of data for analytical purposes.

Robust Fraud Detection Solutions

Fraud detection is critical for minimizing losses and ensuring the integrity of insurance operations. Espire’s solutions enhance fraud detection capabilities through:

- Pattern Recognition: Utilizing machine learning algorithms to identify patterns and anomalies that suggest fraudulent activities, improving detection rates and reducing false positives.

- Real-Time Monitoring: Implementing real-time monitoring systems that continuously analyze transactions and claims to detect suspicious behavior promptly.

- Automated Alerts: Setting up automated alerts to notify insurers of potential fraud, enabling swift investigation and intervention.

Operational Excellence

Espire’s data and analytics solutions streamline insurance operations, improving efficiency and reducing costs:

- Process Automation: Automating routine tasks such as data entry, policy administration, and claims processing to reduce manual workload and enhance productivity.

- Performance Analytics: Providing insights into operational performance through advanced analytics, helping insurers identify bottlenecks and areas for improvement.

- Resource Optimization: Analyzing resource utilization data to optimize workforce allocation and improve operational efficiency.

Superior Customer Experience

Improving customer experience is a top priority for insurers. Espire helps enhance customer interactions and satisfaction through:

- Personalized Services: Leveraging data analytics to understand customer needs and preferences, enabling insurers to offer tailored products and services.

- Proactive Engagement: Using predictive analytics to anticipate customer needs and engage with them proactively, improving satisfaction and loyalty.

- Multi-Channel Support: Implementing data-driven customer support solutions that provide consistent and efficient service across multiple channels, including phone, email, chat, and social media.

Conclusion

The digital transformation of the insurance industry through data analytics is undeniable. By harnessing data for a competitive edge, adopting data-driven strategies, leveraging machine learning, and utilizing big data for customer-centric solutions, insurers can not only enhance their operational efficiency but also significantly improve profitability and customer satisfaction. As the industry continues to evolve, those who embrace data analytics will be well-positioned to thrive in the competitive landscape of the future.

To leverage the power of data and analytics for your insurance business, connect with our experts today.