Generative AI in insurance transforming the industry with smarter automation | Part1

The insurance industry is undergoing a massive digital transformation, and Generative AI (GenAI) is at the heart of this evolution. From automating underwriting and claims processing to enhancing customer experiences and risk assessment, GenAI is redefining how insurers operate. In this blog, we will explore how GenAI has evolved in the insurance sector, its role, key use cases, and the challenges it has helped overcome.

Evolution of GenAI in the Insurance Sector

Insurance has traditionally been a document-heavy and process-intensive industry. With the rise of artificial intelligence, automation became an essential tool for insurers to improve efficiency. Early AI applications focused on rule-based automation, predictive analytics, and chatbots. However, GenAI has taken AI's capabilities to a new level by enabling machines to generate human-like text, analyze vast datasets, and make informed decisions with minimal human intervention.

The integration of GenAI into insurance began with natural language processing (NLP) models, followed by AI-driven claims automation and fraud detection. Today, insurers leverage GenAI for intelligent underwriting, personalized policy recommendations, and automated customer interactions, driving better business outcomes and customer satisfaction.

Role of GenAI in the Insurance Sector

Generative AI (GenAI) is revolutionizing the insurance industry by enhancing operational efficiency, automating complex processes, and improving decision-making. Unlike traditional AI, which primarily focuses on pattern recognition and rule-based automation, GenAI can generate new insights, create content, and offer highly personalized customer experiences. Let’s explore the key roles GenAI plays in the insurance sector:

Automating Claims Processing for Speed and Accuracy

Claims processing is one of the most critical and time-consuming functions in the insurance industry. Traditionally, claims assessment required manual verification, document review, and approval, leading to delays and inefficiencies. GenAI automates this process by:

- Extracting key information from claim documents using Natural Language Processing (NLP).

- Cross-referencing claims with historical data to detect anomalies or fraudulent patterns.

- Predicting the likelihood of claim approval or rejection based on predefined criteria.

- Enabling faster payouts by reducing manual intervention.

By automating these tasks, insurers can process claims more efficiently, reducing turnaround times and improving customer satisfaction.

Enhancing Underwriting with AI-Powered Risk Assessment

Underwriting involves evaluating risks associated with policy issuance. Traditional underwriting relied on static data and human expertise, making it prone to inconsistencies. GenAI enhances underwriting by:

- Analyzing real-time data from multiple sources, including medical records, financial histories, and IoT-enabled devices.

- Identifying potential risks with predictive modeling, helping insurers determine optimal policy terms.

- Automating policy generation with personalized terms tailored to individual risk profiles.

By leveraging AI-driven underwriting, insurers can reduce risk exposure while offering more competitive and customized policies.

Improving Customer Experience with AI-Powered Chatbots and Virtual Assistants

Customer engagement is a key differentiator in the insurance industry. GenAI-powered chatbots and virtual assistants are transforming how insurers interact with customers by:

- Providing 24/7 support for policy inquiries, renewals, and claims assistance.

- Offering personalized policy recommendations based on customer needs and behavior.

- Simplifying complex insurance jargon by generating easy-to-understand responses.

With AI-driven customer support, insurers can offer seamless and responsive interactions, improving policyholder satisfaction and retention rates.

Fraud Detection and Prevention with AI-Driven Insights

Insurance fraud costs businesses billions of dollars annually. Detecting fraudulent claims manually is both time-consuming and inefficient. GenAI strengthens fraud detection by:

- Identifying suspicious patterns and inconsistencies in claims data.

- Comparing current claims with past fraudulent activities to flag potential risks.

- Automating investigations and escalating cases that require human intervention.

By proactively detecting fraud, insurers can mitigate financial losses and maintain the integrity of their services.

Optimizing Policy Pricing and Personalization

Traditional insurance pricing models are based on historical data and broad risk categories, often leading to generic pricing structures. GenAI enables dynamic pricing by:

- Analyzing customer behavior, lifestyle patterns, and risk indicators in real time.

- Offering flexible pricing models that adjust based on evolving risk profiles.

- Enhancing policy personalization to cater to individual customer needs.

With AI-driven pricing, insurers can attract more customers with competitive and fair policy rates.

Automating Regulatory Compliance and Documentation

Compliance is a major challenge for insurers due to evolving regulatory requirements. Failing to adhere to these regulations can result in penalties and reputational damage. GenAI simplifies compliance by:

- Automating the creation and validation of regulatory reports.

- Ensuring policy documents meet industry and government compliance standards.

- Reducing human errors in documentation and audit processes.

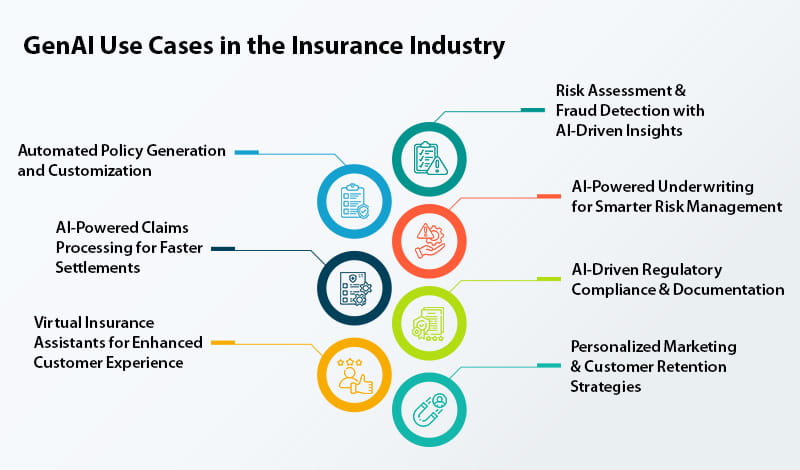

GenAI Use Cases in the Insurance Industry

Generative AI (GenAI) is rapidly transforming the insurance industry by automating processes, enhancing customer experiences, and improving decision-making. By leveraging its ability to analyze vast datasets, generate human-like responses, and detect patterns, insurers can streamline operations and drive business growth. Here are some of the most impactful use cases of GenAI in the insurance industry:

Automated Policy Generation and Customization

Traditional insurance policy creation involves extensive documentation, manual data entry, and legal verification, making it time-consuming and prone to human errors. GenAI streamlines this process by:

- Generating policy documents automatically based on customer data, risk profiles, and industry regulations.

- Offering personalized policy recommendations by analyzing individual customer needs and preferences.

- Ensuring compliance with local and international regulations through AI-driven document verification.

By automating policy generation, insurers can reduce operational costs, enhance efficiency, and offer tailored insurance products to customers.

AI-Powered Claims Processing for Faster Settlements

Claims processing is one of the most critical functions in the insurance sector, often plagued by long verification cycles and manual bottlenecks. GenAI optimizes this process by:

- Automating Claims Assessment: AI models analyze claim documents, medical reports, and policy terms to determine eligibility instantly.

- Detecting Fraudulent Claims: AI flags suspicious claims based on historical fraud patterns and anomaly detection.

- Streamlining Communication: AI-driven chatbots and virtual assistants guide policyholders through the claims submission process.

By integrating AI into claims processing, insurers can significantly reduce turnaround times, minimize manual errors, and improve customer satisfaction.

Virtual Insurance Assistants for Enhanced Customer Experience

Customer service is a key differentiator in the insurance industry, and GenAI-powered virtual assistants are transforming how insurers interact with policyholders. These AI-driven assistants:

- Provide 24/7 support for queries related to policies, premiums, and claims.

- Generate personalized responses based on a customer’s profile and history.

- Help customers choose the best policy by analyzing their risk factors and coverage needs.

- Assist in policy renewals and modifications without human intervention.

Virtual insurance assistants not only enhance customer engagement but also reduce call center workloads, improving overall operational efficiency.

Risk Assessment & Fraud Detection with AI-Driven Insights

Insurance fraud costs the industry billions of dollars annually, making fraud prevention a top priority. GenAI helps insurers combat fraud by:

- Analyzing Large Datasets: AI scans through vast amounts of claim records to identify unusual patterns.

- Predicting Fraudulent Behavior: Machine learning models flag potentially fraudulent claims based on past data.

- Automating Risk Analysis: AI evaluates a policyholder’s risk profile using historical records, financial data, and behavioral insights.

By leveraging AI for fraud detection, insurers can reduce financial losses and ensure fair claim settlements.

AI-Powered Underwriting for Smarter Risk Management

Underwriting is a complex process that requires evaluating multiple risk factors before issuing a policy. GenAI enhances underwriting by:

- Processing Unstructured Data: AI analyzes social media activity, financial records, and lifestyle habits to assess risk more accurately.

- Predicting Claim Likelihood: AI models estimate the probability of future claims based on historical trends.

- Personalizing Policy Pricing: AI helps insurers offer dynamic pricing models based on individual customer risk profiles.

By automating underwriting, insurers can improve accuracy, reduce manual workload, and offer more competitive policy pricing.

AI-Driven Regulatory Compliance & Documentation

Insurance companies must comply with strict regulatory frameworks, making compliance management a crucial function. GenAI simplifies this process by:

- Automating Report Generation: AI creates and updates compliance reports in real time.

- Ensuring Policy Adherence: AI verifies that policy documents meet local and global regulatory standards.

- Reducing Audit Risks: AI continuously monitors transactions and claims to flag potential compliance issues.

By implementing AI-driven compliance solutions, insurers can reduce regulatory risks and improve transparency in their operations.

Personalized Marketing & Customer Retention Strategies

Marketing in the insurance sector is becoming more data-driven, and GenAI is playing a key role in personalizing customer interactions. AI enhances marketing efforts by:

- Generating Hyper-Personalized Content: AI creates customized emails, SMS, and policy recommendations based on customer preferences.

- Predicting Customer Churn: AI identifies customers who are likely to leave and suggests proactive retention strategies.

- Automating Lead Nurturing: AI-driven chatbots engage with potential customers, answer questions, and guide them toward policy purchases.

By leveraging AI in marketing, insurers can improve customer acquisition, retention, and engagement.

Challenges GenAI Helped to Overcome in the Insurance Sector

The insurance industry has long been burdened by inefficiencies, outdated processes, fraud risks, and regulatory complexities. Traditional approaches to underwriting, claims processing, and customer engagement often resulted in delays, errors, and increased operational costs. However, the introduction of Generative AI (GenAI) has significantly transformed the sector, addressing many of these persistent challenges. Let’s explore the key obstacles that GenAI has helped overcome:

Slow and Inefficient Claims Processing

The Challenge

Claims processing has historically been a slow and cumbersome task, involving manual verification, documentation reviews, and approvals. These delays often lead to customer dissatisfaction and increased operational costs.

How GenAI Solves It

- Automated Document Processing: AI-powered tools extract and verify information from claim forms, medical records, and accident reports, speeding up assessment.

- Predictive Claims Evaluation: AI models analyze historical claims data to predict the validity of new claims and detect fraudulent activities.

- Instant Claim Approvals: GenAI can automate straightforward claims processing, enabling instant approvals and reducing turnaround time.

Impact: Faster claim settlements, improved customer satisfaction, and reduced administrative burden on insurance teams.

High Risk of Fraudulent Claims

The Challenge

Insurance fraud is a major problem, costing the industry billions of dollars annually. Fraudulent claims often go undetected due to the complexity of manual fraud detection processes.

How GenAI Solves It

- Anomaly Detection: AI analyzes claims patterns and flags inconsistencies or suspicious behaviors.

- Real-Time Fraud Identification: AI compares new claims against past fraud cases to detect similarities.

- Deep Learning for Image and Video Verification: AI can verify accident photos and videos to determine authenticity, reducing false claims.

Impact: Reduced financial losses due to fraud, improved trust in insurance companies, and more accurate claims processing.

Complex and Lengthy Underwriting Processes

The Challenge

Traditional underwriting relies heavily on manual data entry, risk assessment, and extensive documentation, often leading to delays and human errors.

How GenAI Solves It

- Automated Risk Assessment: AI evaluates data from multiple sources, including IoT devices, medical records, and financial history, to determine risk levels.

- Dynamic Pricing Models: AI helps insurers offer personalized premium pricing based on real-time risk analysis.

- Faster Policy Issuance: AI automates policy document generation, reducing manual workload and ensuring compliance with regulations.

Impact: Improved efficiency, accurate risk assessment, and enhanced customer experiences with faster policy approvals.

Poor Customer Engagement and Support

The Challenge

Traditional customer support models struggle with handling high volumes of queries, leading to slow response times and inconsistent service quality.

How GenAI Solves It

- AI-Powered Virtual Assistants: Chatbots and voice assistants provide 24/7 customer support for policy inquiries, renewals, and claims assistance.

- Personalized Recommendations: AI analyzes customer data to offer tailored policy suggestions.

- Automated FAQs and Query Resolution: AI generates responses to common customer inquiries, reducing dependency on human agents.

Impact: Enhanced customer engagement, faster query resolution, and improved policyholder satisfaction.

Regulatory Compliance and Documentation Challenges

The Challenge

Insurance companies operate in highly regulated environments, requiring them to comply with numerous laws, data privacy regulations, and industry standards. Manual compliance checks are time-consuming and prone to errors.

How GenAI Solves It

- Automated Regulatory Compliance Monitoring: AI scans policies and claims to ensure they meet industry regulations.

- Error-Free Documentation: AI reduces human errors in policy writing and compliance reports.

- Instant Audit Readiness: AI organizes and verifies compliance documentation, making audits seamless.

Impact: Reduced legal risks, improved compliance efficiency, and minimized financial penalties.

Outdated and Inaccurate Risk Assessment Models

The Challenge

Traditional risk assessment models rely on historical data, which may not accurately reflect a policyholder’s real-time risk profile. This often leads to mispriced policies and potential losses.

How GenAI Solves It

- Real-Time Data Integration: AI continuously updates risk models using real-time customer data from IoT devices, telematics, and wearable health trackers.

- Behavior-Based Pricing: AI-driven analytics allow insurers to adjust policy pricing dynamically based on real-time risk indicators.

- Improved Predictive Analytics: AI forecasts potential risks by analyzing market trends, natural disasters, and behavioral data.

Impact: More accurate risk assessment, fairer policy pricing, and reduced financial losses due to miscalculated risks.

Conclusion

Generative AI has emerged as a game-changer in the insurance industry, driving efficiency, enhancing customer experience, and mitigating risks. As insurers continue to integrate AI into their operations, the sector is set for unprecedented transformation. In Part 2 of this series, we will explore key GenAI trends for 2025, best practices for implementation, and how Espire helps insurance businesses achieve seamless AI adoption.

Looking to transform your insurance business with AI-driven solutions? Connect with our experts at Espire to explore how GenAI can revolutionize your operations.