Maximizing Efficiency and Accuracy: How OpenText Exstream Automation Revolutionizes Insurance Processes | Part 1

The insurance industry is undergoing a profound transformation, driven by increasing customer expectations, regulatory pressures, and the need for greater operational efficiency. Traditionally, insurance providers have relied on manual processes to handle policy documentation, claims processing, and customer communications. However, as the market becomes more competitive and digital-first solutions redefine customer interactions, insurers must embrace automation to stay relevant.

In today’s fast-paced environment, accuracy, speed, and personalization are crucial in delivering seamless customer experiences. Clients expect real-time updates, personalized policy details, and rapid claims processing - features that are difficult to achieve with outdated systems and manual document workflows. Any delay in communication or errors in policy documentation can lead to dissatisfaction, financial losses, and even regulatory fines.

To address these challenges, insurance companies are turning to OpenText Exstream automation, a robust enterprise-level platform that streamlines document generation, ensures compliance, and enhances customer engagement. By automating critical processes, insurers can eliminate inefficiencies, minimize human errors, and significantly improve the speed and accuracy of policy-related communications.

Moreover, the integration of Generative AI (GenAI) with OpenText Exstream is further enhancing automation capabilities. AI-powered tools enable insurance providers to analyze customer data, generate tailored policy documents, and predict customer needs, leading to better decision-making and improved client relationships. This synergy between automation and AI is not only helping insurers reduce costs but also positioning them as customer-centric organizations in an increasingly digital marketplace.

Understanding OpenText Exstream Automation

As the insurance industry moves toward digitization and automation, the need for efficient document management solutions has never been greater. OpenText Exstream is an advanced enterprise-level document automation platform that enables insurers to streamline document generation, enhance customer communications, and ensure regulatory compliance.

Unlike traditional document management systems, OpenText Exstream is designed to handle large-scale, complex documentation processes while maintaining a high level of personalization and accuracy. This makes it an ideal solution for insurance providers dealing with policy creation, claims processing, regulatory reporting, and customer correspondence.

What is OpenText Exstream?

OpenText Exstream is a customer communication management (CCM) platform that helps organizations design, manage, and deliver personalized, omnichannel communications at scale. It automates the creation of documents such as policy statements, claims reports, customer notifications, and marketing materials, ensuring that all communications are consistent, compliant, and relevant to the recipient.

By leveraging automation, artificial intelligence, and data-driven insights, OpenText Exstream enables insurers to reduce manual intervention, eliminate errors, and significantly speed up document generation. This results in improved customer satisfaction, operational efficiency, and cost savings.

Key Features of OpenText Exstream

OpenText Exstream is equipped with powerful features that make it a game-changer for insurance companies. These include:

- Advanced Document Automation – The platform allows insurers to automatically generate, customize, and distribute documents based on predefined templates and business rules.

- Personalization Capabilities – With the help of dynamic data integration, insurers can tailor communications to individual customers, enhancing engagement and satisfaction.

- Omnichannel Delivery – OpenText Exstream supports multiple channels, including email, SMS, web portals, print, and mobile apps, ensuring seamless customer interactions.

- Compliance and Security – The platform helps insurers meet strict regulatory requirements by enforcing standardized workflows, audit trails, and security protocols.

- Integration with AI and Analytics – By integrating with GenAI and data analytics tools, OpenText Exstream provides actionable insights that enable insurers to optimize their customer communication strategies.

How OpenText Exstream Transforms Insurance Operations

The adoption of OpenText Exstream enables insurers to modernize their operations by eliminating inefficiencies in document management and customer communication. Traditionally, policy creation and claims processing involved extensive manual work, leading to delays, errors, and high operational costs.

With OpenText Exstream, insurers can:

- Automate Policy Document Generation – The system pulls data from multiple sources, ensuring that policy documents are always up-to-date, accurate, and tailored to customer needs.

- Accelerate Claims Processing – Automating claims communication allows insurers to reduce processing time, improving customer experience and reducing costs.

- Enhance Compliance Management – OpenText Exstream ensures that all documents are generated in accordance with industry regulations, reducing the risk of legal and financial penalties.

- Improve Customer Engagement – The ability to send real-time, personalized notifications strengthens relationships with policyholders and increases customer loyalty.

The Role of AI in OpenText Exstream Automation

With the integration of Generative AI (GenAI) and machine learning, OpenText Exstream takes document automation to the next level. AI-powered tools analyze customer behavior, preferences, and historical interactions to generate more relevant and predictive communications.

For example, insurers can use AI to:

- Predict Customer Needs – By analyzing past interactions, AI can suggest personalized insurance plans that align with a customer’s lifestyle.

- Automate Customer Queries – Chatbots and AI-driven virtual assistants can handle customer inquiries, reducing the burden on human agents.

- Detect Fraud in Claims Processing – AI-powered algorithms can identify inconsistencies and anomalies in claims, helping insurers prevent fraudulent activities.

- Optimize Document Creation – AI ensures that policy and claims documents are generated with high precision, reducing manual review efforts.

Why Insurance Companies are Adopting OpenText Exstream

The adoption of OpenText Exstream is rapidly increasing in the insurance industry due to its scalability, efficiency, and ability to enhance customer experience. Insurers are leveraging the platform to:

- Reduce Operational Costs – Automation eliminates the need for manual document processing, cutting down costs associated with printing, storage, and human resources.

- Increase Efficiency – Faster document generation means quicker policy approvals, claims settlements, and customer communications, leading to higher customer satisfaction.

- Ensure Data Accuracy – OpenText Exstream integrates with customer databases, ensuring that every document is generated with the most accurate and up-to-date information.

- Stay Competitive in a Digital Era – As the insurance industry moves towards digital-first strategies, adopting OpenText Exstream allows insurers to offer better, faster, and more personalized services than their competitors.

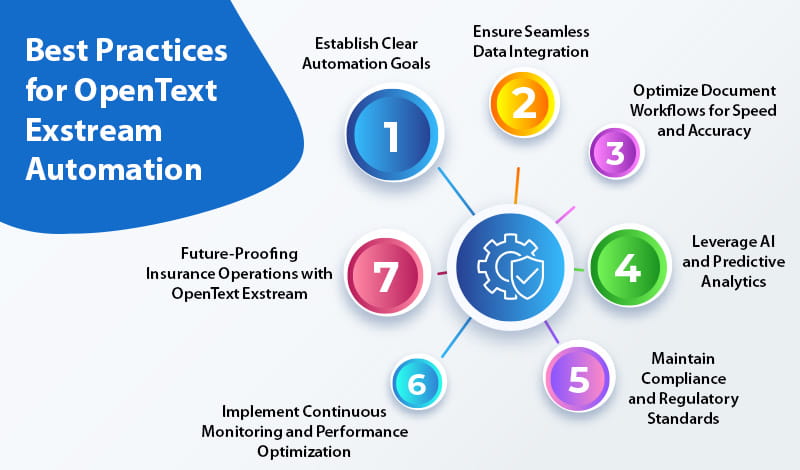

Best Practices for OpenText Exstream Automation

Implementing OpenText Exstream automation in the insurance industry can significantly enhance operational efficiency, customer satisfaction, and compliance adherence. However, to maximize its potential, insurers must follow best practices that ensure a smooth transition, effective execution, and long-term success. From optimizing document workflows to leveraging AI-driven insights, these practices can help insurance providers achieve the highest return on investment (ROI) and enhance overall business agility.

Establish Clear Automation Goals

Before integrating OpenText Exstream, insurers must define clear automation objectives based on their business requirements. Whether the focus is on automating policy documentation, streamlining claims processing, or improving customer communication, having a strategic roadmap ensures a seamless deployment.

Companies should begin by:

- Identifying pain points in existing document management processes.

- Setting measurable Key Performance Indicators (KPIs) such as reducing document processing time by 50% or minimizing compliance errors by 30%.

- Aligning automation goals with overall business and customer experience (CX) strategies.

Ensure Seamless Data Integration

One of the key strengths of OpenText Exstream is its ability to integrate with existing insurance systems, including policy administration systems, CRM platforms, claims management software, and regulatory databases. However, without proper data integration strategies, insurers may face inconsistencies, inefficiencies, or incomplete automation workflows.

To maximize efficiency:

- Ensure OpenText Exstream integrates with core enterprise applications such as Salesforce, SAP, Microsoft Dynamics, and Guidewire.

- Use AI-driven data validation to detect and correct errors in policyholder information before documents are generated.

- Adopt a centralized data repository to maintain a single source of truth, reducing data discrepancies across different teams and departments.

Optimize Document Workflows for Speed and Accuracy

One of the primary advantages of OpenText Exstream automation is its ability to accelerate document generation while ensuring high levels of accuracy. However, without an optimized workflow, insurers may not be able to fully realize its benefits.

To improve efficiency:

- Automate repetitive tasks such as policy renewals, claims communications, and compliance reporting to reduce human intervention.

- Implement workflow templates for different types of insurance documents, ensuring consistency across all customer communications.

- Use dynamic content personalization to tailor policies, claims letters, and notifications to individual customers based on real-time data insights.

Leverage AI and Predictive Analytics

The integration of Generative AI (GenAI) and predictive analytics with OpenText Exstream allows insurers to go beyond basic automation and enhance customer interactions with intelligent, data-driven communications. AI-powered features enable insurers to:

- Analyze customer behavior patterns and predict policyholder needs, allowing for more personalized policy recommendations.

- Generate automated risk assessment reports, improving underwriting efficiency.

- Implement real-time fraud detection algorithms to identify inconsistencies in claims documents.

- Enhance customer interactions by providing AI-driven chatbots and virtual assistants that generate automated policy documents and claim status updates.

Maintain Compliance and Regulatory Standards

The insurance industry is heavily regulated, and non-compliance can lead to severe penalties and reputational damage. OpenText Exstream provides built-in compliance features, but insurers must adopt best practices to ensure ongoing adherence to industry regulations such as GDPR, HIPAA, and Solvency II.

To maintain compliance:

- Automate compliance monitoring by integrating OpenText Exstream with regulatory databases.

- Use predefined compliance templates for policy documents and claims communications to ensure adherence to local laws.

- Enable role-based access control to ensure only authorized personnel can edit and approve critical insurance documents.

- Conduct regular audits to verify document accuracy and compliance with industry mandates.

Implement Continuous Monitoring and Performance Optimization

To ensure long-term success, insurers must regularly monitor and optimize their OpenText Exstream automation workflows. This involves analyzing key performance metrics and making continuous improvements to enhance efficiency and effectiveness.

Key steps include:

- Tracking system performance through real-time dashboards that provide insights into document processing speed, error rates, and customer response times.

- Collecting customer feedback to refine communication strategies and ensure policyholders receive relevant, timely information.

- Regularly updating automation rules and AI algorithms to reflect changing business needs and new regulatory requirements.

- Training employees on automation best practices to ensure smooth adoption across teams.

Future-Proofing Insurance Operations with OpenText Exstream

As the insurance industry continues to evolve, insurers must stay ahead of digital transformation trends. OpenText Exstream’s scalability and AI-driven capabilities ensure that it can adapt to emerging technologies, regulatory changes, and evolving customer expectations.

To future-proof their operations:

- Embrace cloud-based deployments for improved scalability and security.

- Invest in AI-driven automation upgrades to enhance document personalization and predictive customer engagement.

- Expand omnichannel communication strategies to include mobile messaging, interactive PDFs, and self-service customer portals.

- Explore blockchain integration for enhanced security and fraud prevention in claims documentation.

Conclusion

OpenText Exstream automation is revolutionizing the insurance industry by enhancing efficiency, improving accuracy, and transforming customer interactions. By automating document generation, streamlining claims processing, ensuring regulatory compliance, and enabling personalized communication, insurers can deliver a seamless and responsive experience to their customers.

However, this is just the beginning. In the next part of this blog, we will explore the key benefits of OpenText Exstream Automation, what were the challenges that insurance businesses facing that the automation of CCM platform helped to overcome in greater detail and examine how Espire helps insurance businesses implement this powerful solution seamlessly.

Looking to elevate your insurance operations with automation? Connect with our experts today to learn how OpenText Exstream and Espire’s expertise can drive efficiency and innovation for your business. Stay tuned for Part 2!